Agency Positioning for Multiple Verticals: The Strategic Framework for Horizontal Success

Early on, new agency work is the uncertainty. You're hustling for any project that comes through the door, grateful for each opportunity to keep the lights on.

But then as you grow, something changes.

The problem is no longer finding work, it's feeding a system that now requires work continuously. Salaries exist independent of pipeline. Teams must stay utilized. Forecasts must be credible. Your agency cannot simply win occasionally, it must win reliably.

This shift leads many agency founders to a natural conclusion: serve multiple industries so revenue never depends on one market's mood. Diversification appears to convert uncertainty into stability.

From an operational perspective, this reasoning is correct. But it ends up creating friction in the part of your business that determines how difficult it is to win each deal, your positioning and sales process.

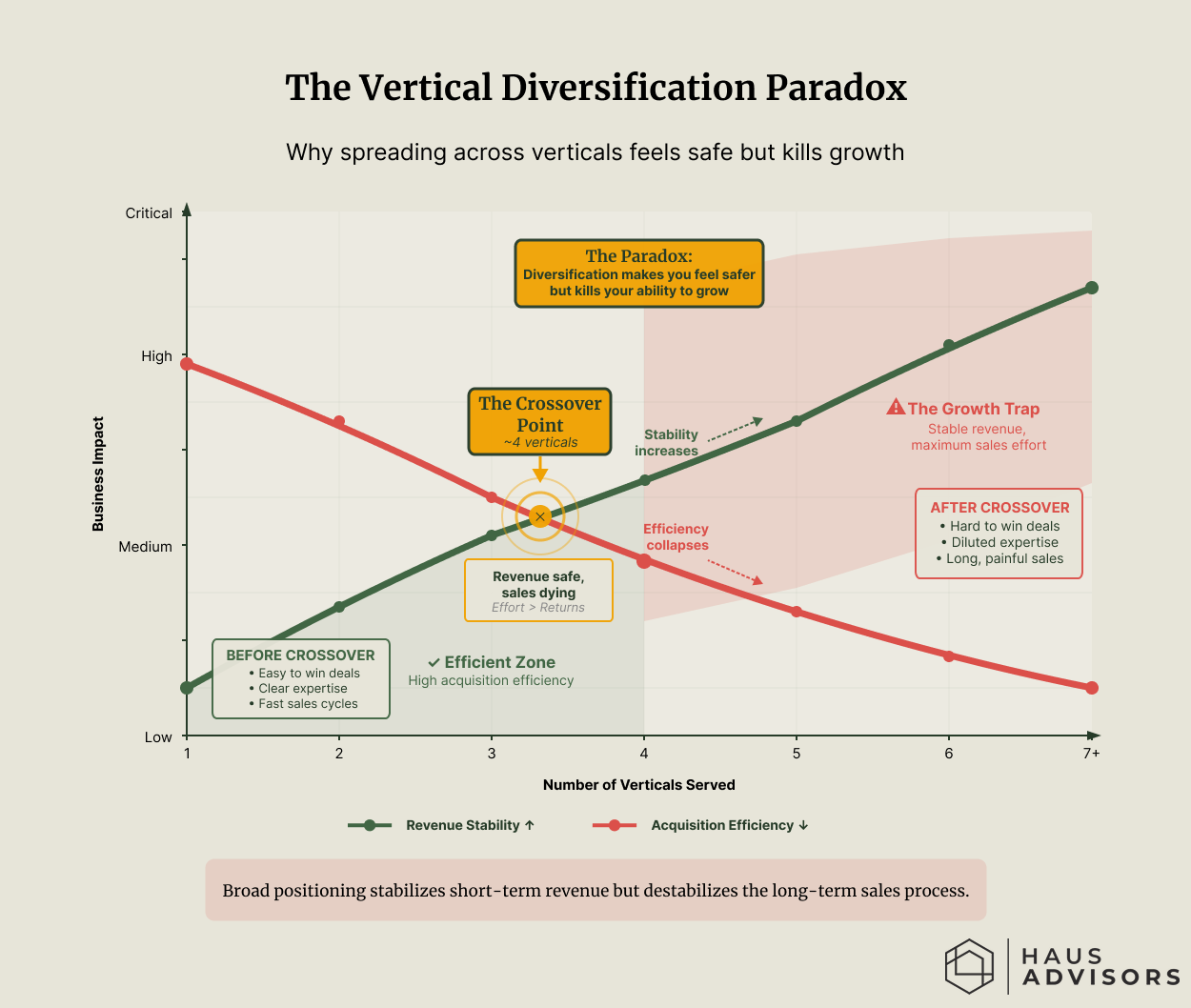

The Growth Trap: As you add verticals, your short-term revenue becomes safer (diversified risk), but your long-term sales process becomes harder (diluted message). Most agencies stall where these two lines cross.

Here's the thing: you don't need to fire your existing clients to fix your positioning problem. You need a systematic approach to creating relevance across the verticals you serve.

This guide covers the framework for making agency positioning for multiple verticals actually work.

When "More Pipeline" Means "More Effort"

Two agencies can generate identical revenue while living in completely different realities. One speaks with a handful of qualified prospects to close a project. The other must speak with many more prospects to achieve the same result.

The difference? Positioning clarity.

Broad positioning increases the number of possible buyers while at the same time increasing the work required to convert each one. You end up in what I call the "Swiss Army Knife" trap, listing every service for every industry, becoming memorable to none.

Many agencies fall into this pattern:

Healthcare companies see you as "capable but not specialized in healthcare."

Ecommerce brands view you as "technical but probably don't understand retail."

SaaS startups think you're "experienced but maybe too enterprise-focused."

The result? You're viewed as capable but ambiguous. You rely on the client to mentally translate your general skills to their specific problems.

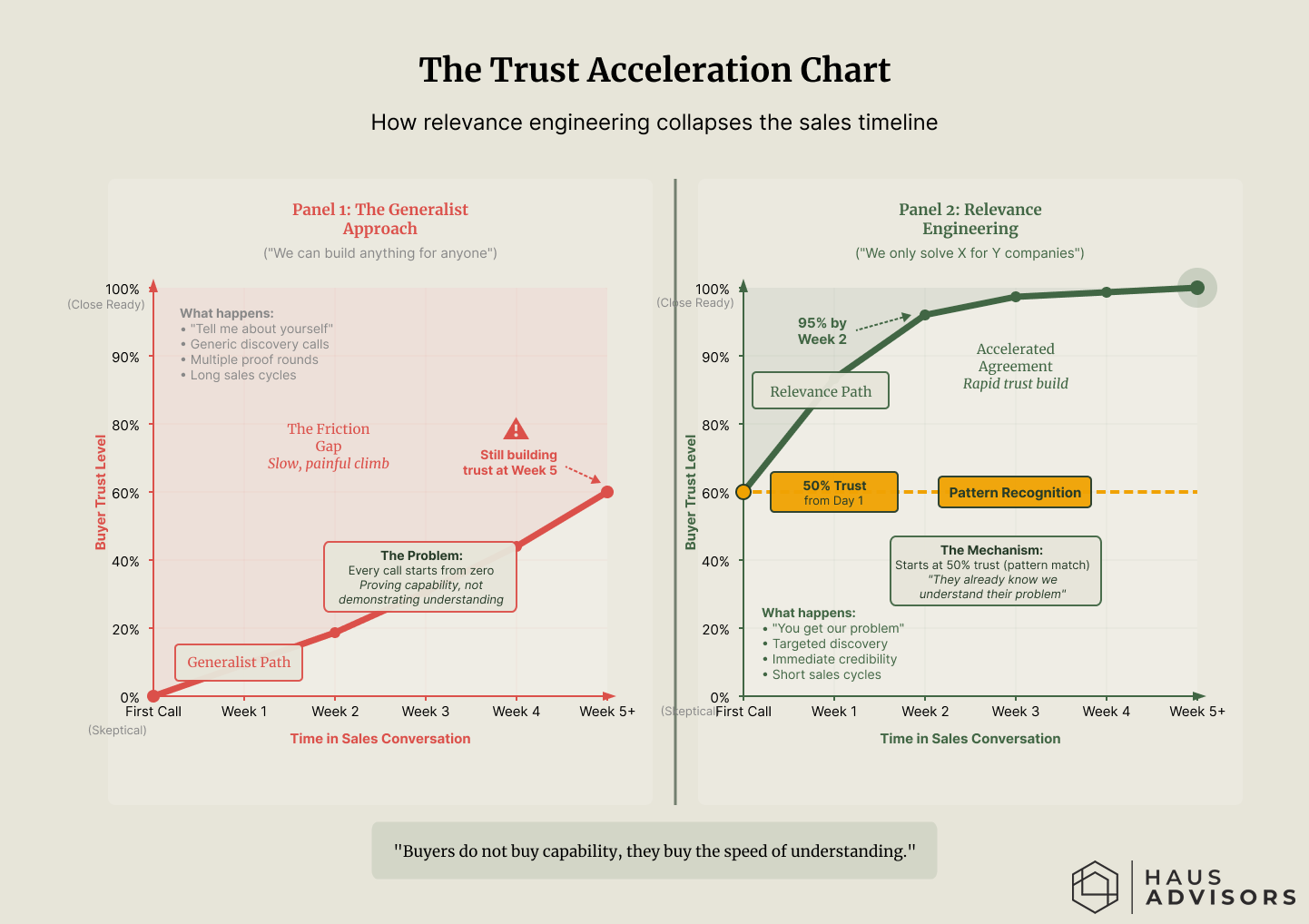

In some conversations, you start halfway to trust. In others, you start at zero and spend your entire sales cycle trying to get from zero to halfway.

The Friction Gap: Generalist agencies (Left) must educate every buyer from scratch. Relevance Engineered agencies (Right) trigger "Pattern Recognition" immediately, starting the sales conversation halfway to the close.

How Buyers Actually Decide

Professional service buyers rarely question whether a credible agency can technically perform a task. They question how many unforeseen complications will appear during the project.

This is where pattern recognition comes into play.

Buyers look for familiarity, evidence you've solved their specific constraints before. A firm that regularly solves a recognizable problem appears predictable. A firm that solves many unrelated problems appears capable but unpredictable.

The multi-vertical challenge is creating that "predictable pattern" across multiple industries without actually being a single-industry specialist. Risk reduction trumps capability demonstration every time.

The Framework: How to Execute Multi-Vertical Positioning

If you want to maintain your horizontal revenue model, you must change your vertical marketing model. Here are the four steps to doing it.

1. Vertical-Specific Value Mapping

The mistake most agencies make is creating one generic value proposition that sounds identical to every industry. "We write high-quality code" means nothing to a healthcare CTO dealing with HIPAA compliance concerns.

Instead, map the specific problems you solve for each vertical and how those problems manifest differently:

Ecommerce clients: You solve scalability challenges, building platforms that handle Black Friday traffic spikes without crashing.

Healthcare clients: You solve data integrity issues, creating HIPAA-compliant systems that protect patient information while enabling clinical workflows.

SaaS clients: You solve integration complexity, building APIs that connect seamlessly with existing enterprise software stacks.

Notice how each description uses the same core technical capabilities but speaks to completely different business concerns. This allows you to demonstrate relevance without pretending to be an industry insider.

2. Unified Messaging Architecture

Create a messaging hierarchy where your core expertise sits at the top, with industry-specific applications branching below.

Level 1 (Master Message): Focus on the technical capability or business outcome you deliver consistently. For example: "We build resilient platforms for high-compliance industries."

Level 2 (Branch Messaging): Address how that capability solves industry-specific challenges using each sector's language and priorities.

This prevents the "everything to everyone" trap while maintaining relevance across your target verticals.

3. The Hub-and-Spoke Content Model

Many multi-vertical agencies suffer from "Scattered Marketing Syndrome", trying to maintain separate campaigns for each vertical spreads resources too thin and dilutes your message.

Use a Hub-and-Spoke model instead:

The Hub: Create foundational content that showcases your methodology, the "how" behind your work. This demonstrates your expertise without requiring industry-specific knowledge.

The Spokes: Develop industry-specific case studies and applications that show the "where", how your methodology applies to each vertical's unique challenges.

This approach reinforces your core positioning while providing the industry context each vertical needs to see relevance.

4. Operational Excellence Without Specialization

Build repeatable processes around your core service delivery, not industry specifics.

Start by training team members on your standardized technical approach. Then layer industry knowledge as needed for specific projects. Create modular service offerings that can be customized per vertical without rebuilding your entire process from scratch.

This maintains operational efficiency while allowing for meaningful customization where it adds real value to the client.

When Does Multi-Vertical Actually Make Sense?

Multi-vertical positioning works best when these conditions align:

Market Opportunity: Your core technical capability applies broadly but isn't commoditized. You solve similar technical problems that manifest differently across industries.

Risk Management: You need to diversify risk across industries with complementary buying cycles. (e.g., Retail clients budget in Q4; B2B software companies plan in Q1).

Competitive Advantage: You can compete on a unique methodology rather than just industry knowledge. Your technical approach creates differentiation, not your vertical expertise.

Client Value: Your clients benefit from "cross-pollination", you bring best practices from consumer interfaces into enterprise software, or retail speed into healthcare systems.

If these don't describe your situation, you might be better served by choosing a single vertical focus.

Common Mistakes to Avoid

Industry Expertise Theater: Don't pretend to be an insider in every industry you serve. Buyers can spot this immediately and it destroys trust. Instead, be honest about your role. Position yourself as the technical expert who partners with the client, the true industry expert, to solve their problem.

The "Menu of Services" Trap: Resist the urge to list every service you can possibly deliver. This creates decision paralysis and makes you appear unfocused. Be selective. Lead with your strongest capability and show how it applies across your target verticals.

Ignoring the Translation Gap: Don't assume "good work speaks for itself." Cross-industry positioning requires more explanation in your sales process, not less. Acknowledge this reality and build systems to handle the additional education and trust-building required.

The Haus Advisors Approach: Relevance Engineering

Traditional advice forces a binary choice: "Niche or die." But many successful agencies grow by solving similar technical problems across different business contexts.

At Haus Advisors, we call this "Relevance Engineering", a systematic approach designed for agencies that want to maintain market breadth while achieving positioning clarity.

The framework rests on four pillars:

Positioning: Clarify your core technical methodology—the "red thread" that connects all your work across industries.

Publishing: Create content that demonstrates expertise through cross-industry examples rather than trying to be a thought leader in every vertical.

Productization: Develop service offerings based on business outcomes, not billable hours or technical features.

Partnerships: Build relationships with industry experts rather than trying to master every vertical yourself.

Our "Why Us" Sprint specifically helps multi-vertical agencies clarify their ideal client profile and sharpen their differentiation message across industries. The goal is solving the "interchangeable agency" problem without forcing you to fire existing clients or abandon proven revenue streams.

Building Stability Through Sequence

Agencies don't need to be permanently specialized to grow consistently. They need at least one place where buyers already understand why they exist before the conversation begins.

The sequence matters: Diversification stabilizes the work once you win it. Recognition stabilizes your ability to win it in the first place. The order in which you pursue these two goals determines how difficult growth feels.

Most agencies diversify first, then struggle with recognition. The framework above helps you build recognition across your existing diversification, without starting over.

If you're tired of the friction that comes with explaining your value in every sales conversation, let's talk about how to engineer your relevance across every vertical you serve.

Ready to clarify your positioning without narrowing your market? Our "Why Us" Sprint helps agencies like yours create clear differentiation that works across multiple industries. Schedule a call to discuss your specific situation.